Medicare Prescription Drug Coverage

Medicare drug coverage is optional and offered to everyone with Medicare. It can help pay for prescription drugs that you need now and may need in the future. If you do not enroll in a drug plan when first eligible for Medicare you will have to pay a penalty if you decide to pick up a plan later on. The penalty is perpetual… you will have to pay it as long as you have the plan. There are a some exceptions to the late-enrollment penalty, though, like having creditable prescription drug coverage (such as drug coverage from an employer or union) or if you get Extra Help (a program to help people with limited income and resources pay Medicare prescription drug program costs.) So, even if you are not in need of any medications at this time, it may be a really good idea to pick up a drug plan to cover the unforeseen.

The two ways to get Medicare Drug Coverage are:

Medicare Drug Plan – These plans add drug coverage to Original Medicare. You must have Medicare Part A (Hospital Insurance) and/or Medicare Part B (Medical Insurance) to join a separate Medicare Drug Plan.

Medicare Advantage Plan – Medicare Advantage Plans with Drug Coverage encompasses Part A Hospital, Part B Medical and Part D Drug Coverage. You must have Part A and Part B to join a Medicare Advantage Plan. Remember, although most do, not all Advantage Plans offer drug coverage.

Medicare Prescription Drug Coverage (Part D) Costs

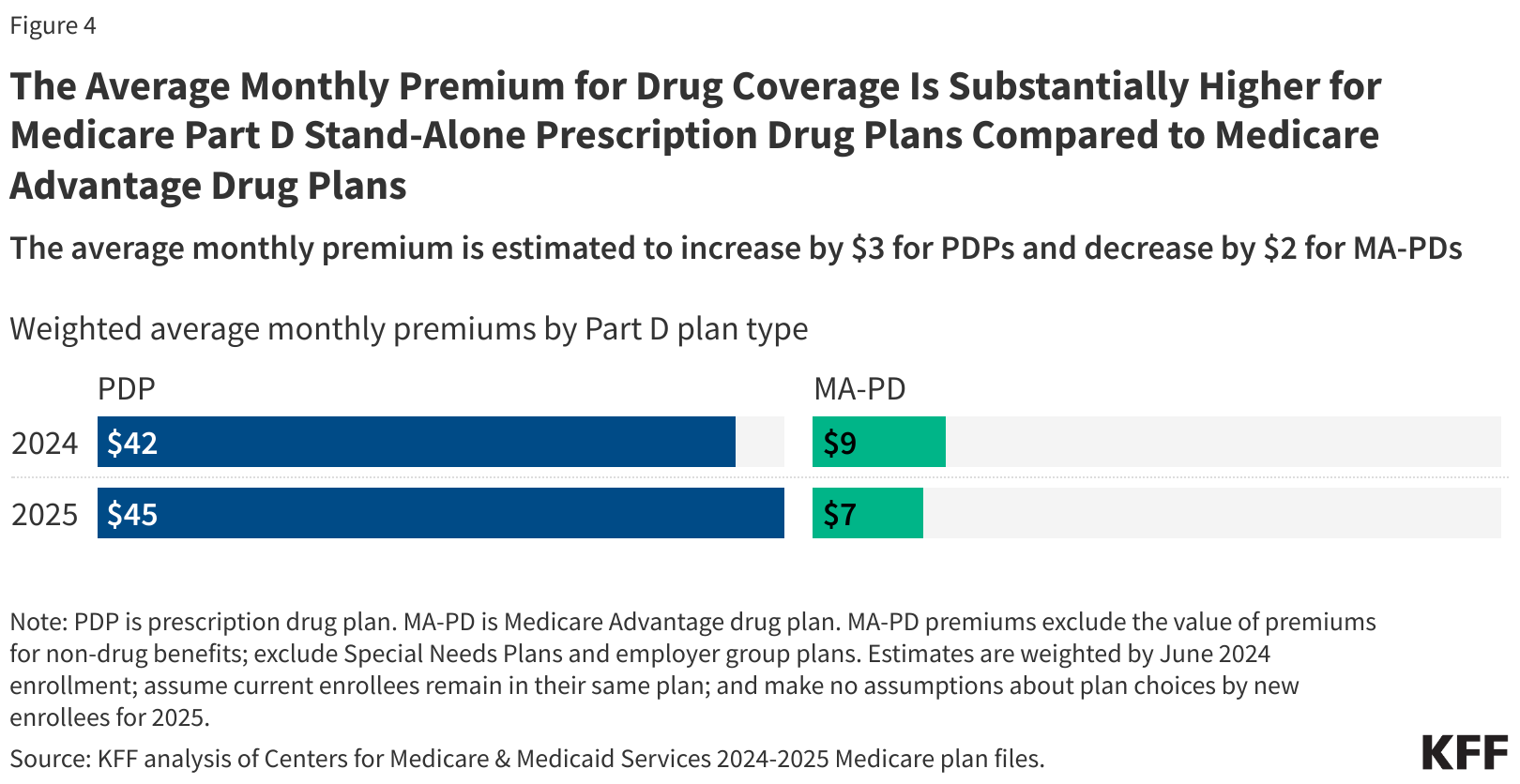

Although Part D Prescription Drug Plans (PDPs) have went up in cost, they are still considered a great value to the consumer. As seen in the chart below, the average cost for prescription drug coverage via a stand-alone PDP in 2025 is only $45/month or $7/month via the Medicare Advantage Plan with built-in drug coverage option. This, of course, is only weighted averages as actual costs will vary depending on location, medication needs and carriers.

We’ll be happy to discuss which options better serve your prescription drug needs. Just give us a call at the number above and we look forward to speaking with you!